Company/Corporate Fixed Deposits (CFD)

Company/Corporate Fixed Deposits (CFD)

Financial institutions and Non-Banking Finance Companies (NBFCs) also accept such deposits. Deposits thus mobilised are governed by the Companies Act under Section 58A. These deposits are unsecured, i.e., if the company defaults, the investor cannot sell the documents to recover his capital, thus making them a risky investment option.

Features of Company Deposits

Although the rules governing the CFD are standard, their features may vary. Here are some important differences.

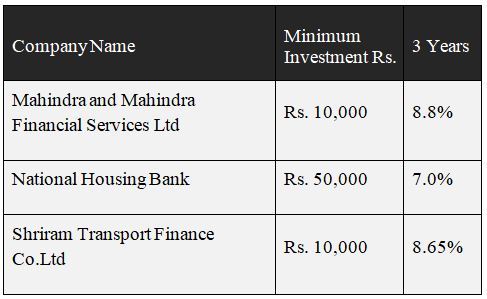

- The minimum deposit amount may vary across tenures and companies. Some deposits may offer a higher rate of interest for a specific tenure but the minimum investment amount may be higher than the regular deposits.

- Some of them may allow online investment in deposit, while most others will have only the offline mode of investment. Some online version may carry an additional rate of interest.

- Some of CFDs may carry additional incentive in case of renewal of deposits with them.

- The CFD ratings across such deposits will vary. Some of them may be A, AA or even AAA rated. However, remember, the ratings may change over time and may not be the same during the currency of the tenure. Lastly, choose from cumulative deposits (where interest is payable at the time of maturity) or con-cumulative CFDs (where interest may be payable at monthly, quarterly, half-yearly or annual basis).

1. Higher Returns

The best thing about a company FD is the interest rate. The rates paid are comparatively much higher than what is paid for an average bank FD. Some corporate FDs even pay more than 9.00% per annum. For example, HUDCO pays 9.15% p.a for tenure of 1 year and 9.40% p.a. for senior seniors for the same investment period.

2. Periodic Interest Payment Options

There are a number of interest payout options to choose from such as monthly, quarterly, half-yearly, and yearly.

3. Credit Ratings

Almost all company FDs are rated by autonomous agencies such as ICRA, CRISIL and CARE. This offers customers a chance to go for a well rated FD.

Disadvantages of Company CFDs

1.Risky

Unlike bank FDs that come with a certain guarantee and deposit insurance, company FDs may be risky. This is what is referred to as ‘default risk’. Though this may be the last resort, it is better to be fully aware of the risk factor before making an investment in such an FD scheme. This risk may be mitigated to some extent by going for a well-rated company scheme and doing some background verification.

2. No Tax Benefit

The interest that is earned on these types of FDs will be fully subject to tax. The tax treatment will be the same and there will be no difference, even when it comes to TDS.

Deposits with Online Payment

FundsTiger is an Online Lending Marketplace where you can search for and avail Fast and Easy loans from almost all the leading Banks and NBFCs. You can Apply for Loans with Best possible Rates of Interest and terms for Personal Loan, Business Loan , Home Loan and Car Refinance Loan.

Company/Corporate Fixed Deposits (CFD)

ReplyDelete